The insurance industry is undergoing a dramatic transformation. What was once a paper-heavy, conservative sector is now at the forefront of digital disruption and technological evolution. From AI-driven underwriting to blockchain-based smart contracts, insurance companies are leveraging cutting-edge innovations to enhance customer experience, improve operational efficiency, and manage risk more intelligently.

As we move further into 2025 and beyond, understanding these trends is critical not just for insurers, but also for consumers, tech innovators, and investors.

This complete guide explores the future of insurance, highlighting key trends, technologies, and innovations shaping the industry—and what they mean for you.

Key Takeaways

- Digital Transformation: The insurance industry is embracing digital technologies such as AI, big data, and blockchain to streamline processes, enhance customer experiences, and improve risk assessment.

- Telematics and IoT: The use of telematics in auto insurance and IoT (Internet of Things) devices in health and home insurance is growing, allowing for real-time data collection and personalized coverage based on actual behavior and needs.

- Personalized and Usage-Based Insurance: The rise of personalized, on-demand, and usage-based insurance models enables customers to pay for insurance based on how much they use or the risk they present, offering more flexible and affordable options.

- Artificial Intelligence and Automation: AI and automation are transforming claims processing, underwriting, and customer service, improving efficiency, accuracy, and speed while reducing operational costs.

- Cyber Insurance: As cyber threats increase, there is growing demand for cyber insurance to protect businesses and individuals from data breaches, ransomware attacks, and other digital risks.

- Sustainability and Climate Risk: With the growing concern over climate change, insurers are focusing on sustainability, offering products that address environmental risks and promote green practices.

- Embedded Insurance: Insurance is increasingly being integrated into everyday transactions, such as purchasing a car or booking a vacation, making it more convenient for customers to secure coverage without additional steps.

- Regulatory and Legal Changes: The insurance industry will continue to evolve as regulations around data privacy, sustainability, and digital transformations become more stringent, influencing how insurers operate and interact with customers.

The Future Of Insurance:

Digital Transformation and InsurTech Boom

The digital revolution has given rise to InsurTech—a wave of startups and technologies designed to disrupt and improve traditional insurance models.

Key Innovations:

- AI-powered chatbots for 24/7 customer service

- Digital claims processing that reduces turnaround time

- Mobile apps for policy management and instant quotes

These technologies offer greater convenience, personalization, and transparency, allowing customers to buy, manage, and claim insurance online with minimal friction.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are becoming central to the insurance value chain. These technologies help insurers:

- Assess risk more accurately

- Detect fraud in real-time

- Automate underwriting decisions

- Personalize premium pricing

For example, AI can analyze thousands of data points from a customer’s driving behavior, health metrics, or credit history to tailor policies with unparalleled precision.

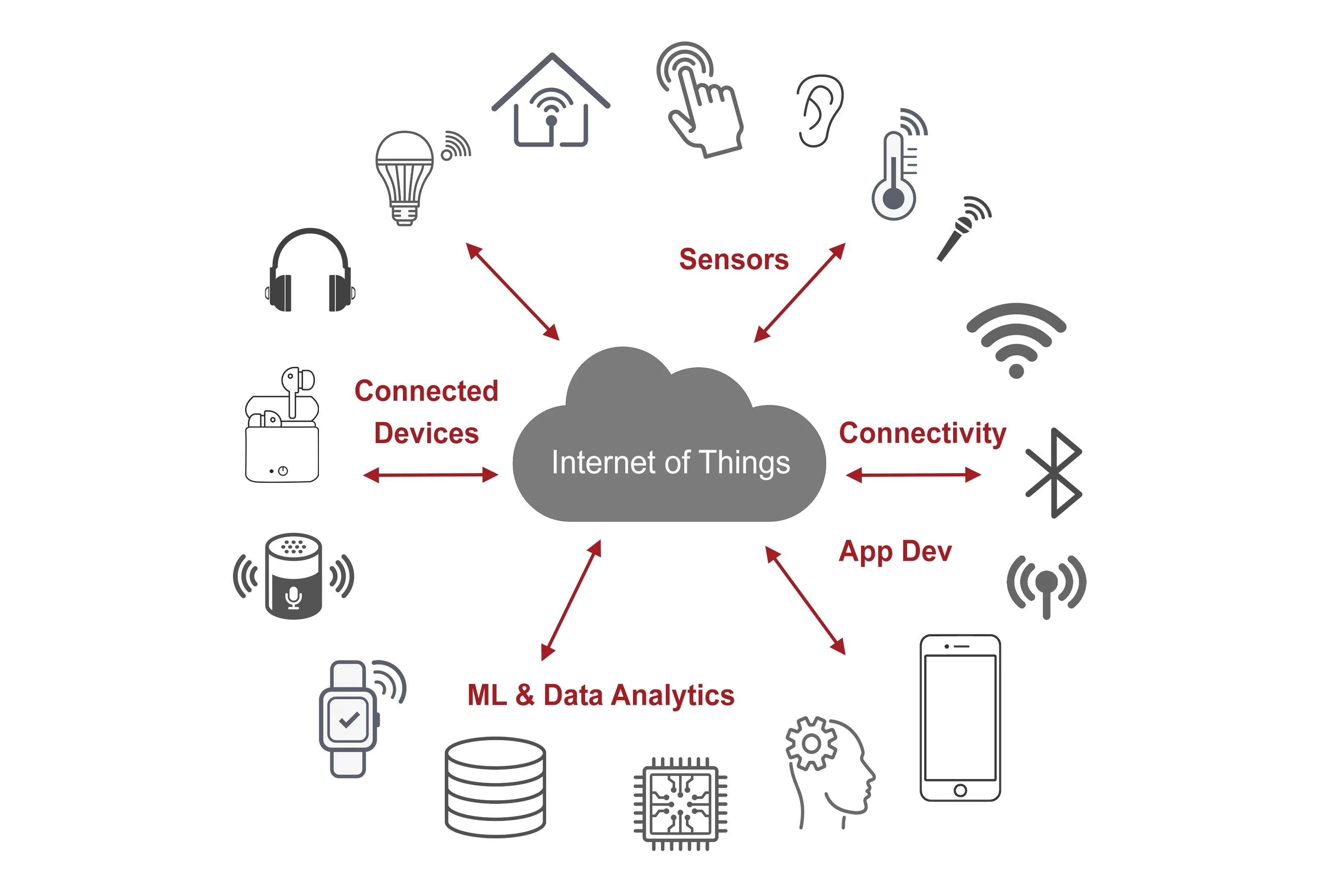

Internet of Things (IoT) and Connected Devices

IoT devices—like wearables, smart home sensors, and telematics in vehicles—are transforming insurance from a reactive to a proactive model.

Applications:

- Auto Insurance: Usage-based insurance (UBI) uses driving data to reward safe behavior.

- Health Insurance: Fitness trackers can influence premiums based on physical activity.

- Home Insurance: Smart sensors detect leaks, fires, or break-ins early, reducing claim costs.

Insurers using IoT gain real-time risk data and offer incentives for customers to reduce risk—creating a win-win for both sides.

Blockchain and Smart Contracts

Blockchain brings transparency, speed, and trust to insurance operations.

Key Uses:

- Smart contracts automate claim payouts when predefined conditions are met.

- Fraud reduction through immutable record-keeping.

- Cross-border insurance facilitated by decentralized verification systems.

For instance, travel insurance can automatically trigger a payout if your flight is canceled—no paperwork required.

Data-Driven Personalization

Insurers are shifting from a one-size-fits-all model to hyper-personalized offerings using large volumes of customer and behavioral data.

Key Enablers:

- Big Data & Advanced Analytics: Pulling data from wearables, IoT devices, telematics, mobile apps, social media, and online activity.

- AI & Machine Learning: Continuously learning from customer behavior to refine offerings in real time.

Examples:

- Dynamic Pricing: Premiums adjust based on real-time behavior — e.g., safe driving habits tracked by telematics can lower auto premiums.

- Tailored Policy Bundles: Insurance products customized to life stages or lifestyle — e.g., a millennial bundle with renters, travel, and gadget insurance.

- Proactive Alerts & Service: Insurers send reminders about lapsing coverage, severe weather alerts, or recommend preventive health screenings.

Impact:

- Enhanced customer engagement and satisfaction.

- Improved retention and reduced churn.

- Increased cross-sell and upsell opportunities.

Climate Change and Environmental Risk Modelin

With natural disasters becoming more frequent and severe, insurers must rethink how they assess and price environmental risk.

Key Innovations:

- Satellite Imaging & Remote Sensing: Real-time assessment of flood zones, wildfire risk, and land erosion.

- AI-Powered Climate Models: Predict storm intensities, wildfire spread, or drought conditions using historical and real-time weather data.

- Dynamic Risk Scoring: Using climate-adjusted data to create dynamic risk profiles, rather than relying solely on traditional geolocation risk.

Examples:

- Property insurance premiums adjusted based on a home’s proximity to wildfire-prone zones or historical flooding data.

- Real-time claims processing using drone imagery after a catastrophe.

- Risk modeling tools like HazardHub, Moody’s RMS, or Jupiter Intelligence are now integral to underwriting.

Impact:

- More accurate pricing of catastrophe risk.

- Better capital allocation and risk diversification.

- Resilience-building incentives for policyholders (e.g., premium discounts for retrofitting homes).

Embedded Insurance and Ecosystem Integration

Insurance is increasingly being bundled into the purchase journey of other products or services — a model known as embedded insurance.

How it Works:

- Insurance is offered at the point of sale — seamlessly integrated into e-commerce, travel booking, car purchases, etc.

- Powered by APIs and platforms like Cover Genius, Qover, and Zego.

Examples:

- Smartphone Insurance: Automatically offered when buying a new phone online or in-store.

- Travel Insurance: Embedded in airline or travel booking platforms, with coverage customized to the trip.

- Auto Insurance: Offered instantly by car dealerships or ride-sharing platforms based on user profile and usage.

Benefits:

- Frictionless experience — no need to shop separately for insurance.

- Higher conversion rates due to convenience and relevance.

- Opens up new distribution channels beyond traditional brokers or agents.

Impact:

Aligns insurance more closely with the customer’s digital journey.

Reaches previously underserved or uninsured segments.

Supports microinsurance and usage-based models.

Cybersecurity and Cyber Insurance

As digital transformation accelerates, cyber risks are becoming more frequent and severe — from ransomware attacks to data breaches. Cyber insurance has emerged as a critical risk mitigation tool, especially for SMBs, healthcare, finance, and other data-intensive industries.

Key Coverages:

- Data Breach & Privacy Liability: Covers costs related to customer data loss, regulatory fines, legal fees, and notifications.

- Ransomware Attacks: Covers ransom payments, recovery services, and negotiation support.

- Phishing & Social Engineering: Protects against financial losses due to deception-based cybercrimes.

- Business Interruption: Compensation for lost income during downtime caused by cyber incidents.

- Incident Response & Forensics: Access to expert cyber teams for immediate damage control, investigation, and remediation.

Emerging Trends:

- Dynamic Risk Assessment: Premiums and coverage terms based on real-time assessments of a company’s cybersecurity posture.

- Bundled Cyber Services: Many insurers now offer cyber hygiene training, vulnerability scanning, and incident simulation drills as part of the policy.

- Regulatory Compliance Tools: Help policyholders meet GDPR, CCPA, HIPAA, and other cybersecurity regulations.

Impact:

- Rapidly growing market, especially as ransomware-as-a-service and supply chain attacks increase.

- Cyber insurance is becoming mandatory for many contracts and partnerships.

- Drives improved cybersecurity practices among policyholders.

Low-Code and No-Code Platforms

Insurers are under pressure to launch products faster, personalize experiences, and digitize legacy operations. Low-code and no-code platforms empower non-technical staff to develop and modify applications, workflows, and digital interfaces without deep programming knowledge.

Key Benefits:

- Accelerated Time-to-Market: Launch new insurance products or customer portals in weeks instead of months.

- Customizable UIs: Tailored interfaces for brokers, agents, and customers to meet specific workflow needs.

- Business Agility: Easily modify policy forms, onboarding flows, or claims processes in response to market shifts or regulatory changes.

Popular Use Cases:

- Claims automation and self-service apps.

- Policy administration tools built in-house.

- Chatbots for 24/7 customer support.

- Underwriting rules engines updated by business analysts without IT involvement.

Tools in Use:

- OutSystems, Mendix, Salesforce Lightning, Appian, and Unqork are popular platforms in insurance innovation.

Impact:

- Reduces IT bottlenecks and enables innovation from within business teams.

- Lowers development costs and improves speed and flexibility.

- Supports a culture of experimentation and customer-centric design.

Shift from Payouts to Prevention

Insurers are moving from being mere financial backstops to becoming active risk partners. By focusing on risk prevention and mitigation, insurers reduce claims frequency while delivering greater value to customers.

Examples by Line of Business:

- Health Insurance:

- Wellness programs, gym memberships, nutrition coaching.

- Incentives for regular checkups or chronic condition management via apps.

- Integration with wearables like Fitbit or Apple Watch.

- Home Insurance:

- Free or subsidized smart sensors (e.g., water leak detectors, fire alarms, and cameras).

- Discounts for homes with enhanced security systems or storm shutters.

- Partnerships with home maintenance providers.

- Auto Insurance:

- Telematics apps that track speed, braking, and route data to offer safe driving feedback.

- Usage-based insurance models (pay-as-you-drive).

- Rewards for low-risk behavior or limited mileage.

Why It Matters:

- Fewer claims mean reduced costs for insurers and policyholders alike.

- Builds customer loyalty by showing proactive care.

- Aligns insurer and customer incentives: Stay healthy, drive safe, secure your home.

This proactive approach enhances customer loyalty and improves the insurer’s bottom line.

Also Read: The Future Of Insurance: Trends And Innovations To Watch

Conclusion

The future of insurance is smart, digital, and customer-centric. As we look ahead to the next decade, it’s clear that emerging technologies and evolving consumer expectations will reshape how insurance is bought, sold, and experienced.

From AI-driven personalization to blockchain-enabled automation, the industry is shifting from a model of reactive compensation to one of proactive protection and empowerment. Insurers that embrace innovation, build trust, and prioritize user-friendly digital experiences will thrive in this new era.

For consumers, these changes offer faster service, lower costs, and customized coverage. For businesses, it’s a call to adapt and lead in a rapidly transforming environment.

FAQs

1. What is InsurTech?

InsurTech refers to technology-driven innovations in the insurance industry, including AI, IoT, and mobile apps that improve service delivery, underwriting, claims, and customer engagement.

2. Are AI and automation replacing human insurance agents?

No, they complement human agents by automating routine tasks. Agents remain vital for complex policies, consultations, and building trust with customers.

3. How does usage-based insurance work?

It uses data from connected devices (e.g., GPS, wearables) to assess real-time behavior, allowing for dynamic premium pricing based on risk level.

4. What is a smart contract in insurance?

A smart contract is a self-executing agreement coded on a blockchain. For example, it can automatically pay out travel insurance if your flight is delayed or canceled.

5. How are insurers responding to climate change?

Insurers are using advanced data analytics, climate modeling, and satellite imagery to assess and price environmental risks more accurately.

6. Is cyber insurance worth it for small businesses?

Yes. As cyber threats grow, even small companies are vulnerable to data breaches, making cyber insurance critical for business continuity and legal compliance.

7. Will personalized insurance affect my privacy?

Personalized insurance relies on data. Reputable insurers must comply with privacy laws and secure customer data, but you should always review how your data is used.